Work Life Balance

- 7 views

Work Life Balance

Pause, Unwind and Reset: Leave Benefits

We all need time off from work to spend with friends and family. We encourage you to plan some time off from work to recharge and renew yourself. To help you do so, 30 days of leaves are given to you every year (April-March) so that you can maintain a healthy work life balance.

Annual Leaves

You have the option of managing your leaves as you deem fit. 30 days of leaves are credited in advance to your leave balance at the beginning of every financial year. The leaves remain active for two financial years. If you join us in the middle of the year, you will receive a prorated * leave credit, which will again remain active until the end of the subsequent financial year.

Of the leaves credited every year, a maximum of 10 leaves are encashable. Hence, at any point of time, the maximum leave balance which you can have is 60 of which 20 will be encashable in nature.

Leave Utilization

Leave utilization follows two principles, (a) leaves that are credited first get used first; (b) encashable leaves are used only when the entire balance of non-encashable leave balance gets exhausted.

Expiry & Encashment

Leaves credited have an expiry date of 24 months. At the end of the financial year, upto 10 leaves credited 24 months ago will get auto-encashed, the remaining will lapse. The encashment amount shall be paid with the April salary as a taxable component. Leave encashment is computed at the rate of your basic salary.

To help you understand this better, let us consider an example . Kiran has 42 unused leaves on 31 st March 2021. 20 of these are encashable leaves and of the remaining 22 leaves, 2 are unused leaves from FY20. Hence, on 1 st April 2021, 10 leaves will be encashed (and paid out with April Salary) as they are unused encashable leaves from FY20 and 2 leaves will expire as they are the remaining unused leaves from FY20. With the credit of 30 new leaves, the revised leave balance for Kiran will be 60 (ie 42 – 2 – 10 + 30). Of these 60, 20 will be encashable leaves. If Kiran uses 45 leaves in FY22, then balance will be 15 leaves and all of them will be encashable in nature. Hence, on 1 st April, 2022, 5 leaves will be encashed.

Applying for Leaves

You are responsible for applying for leaves on ihub and informing your L+1 about your leaves as well, in advance. This would enable us to make appropriate alternate arrangements. You are also expected to update your leaves on the portal so that leave balance can be calculated accurately.

Only in situations of personal emergency should you take leaves without applying for it first. In such situations please inform your L+1 regarding your absence at the earliest over call / text / email. In such cases, you are expected to apply online, do so within a week of resuming work.

Information about leaves is available on ihub. , You can also apply for leaves through Amy (Chat bot).

Half-day leaves are neither productive for you nor the company and hence are discouraged.

To apply for leaves simply follow this path in ihub 2.0:

All Apps -> Self Service -> Leave Request

Exceeding Leave Balance

Due to unforeseen circumstances you may sometimes require more days of leave beyond their annual eligibility and leave balance, in such situations, unpaid/partially paid time off can be granted based on L+1 recommendation and BU HR Heads approval.

In case of resignation

In case an employee is leaving in the middle of the year, advance credit of leaves shall be adjusted for tenure spent, and actual leaves availed shall be set off against this. If the employee has a positive balance of leaves after the adjustment, the revised leave balance will be encashed (all leaves from the current years and encashable leaves from the previous year). If the employee has availed more leaves than the tenure adjusted number, excess leaves cost will be recovered from final settlement.

* Leaves are prorated @2.5 leaves per month for the months remaining in the financial year if your date of joining is before 15 th then the full month credit is given, else 1.5 days credit is given for that month. If the prorated leaves earned in a year (Apr-Mar) is less than or equal to 10, then all of them will be encashable in nature. Any prorated leaves earned in excess of 10 days will not be encashable in nature.

Maternity Leaves and Benefits:

Maternity Leave

All women employees of our company, including trainees, can avail fully paid maternity leave up to 26 weeks of which a maximum of 8 weeks can be taken pre-delivery. There's no limit on the number of children for which the maternity benefits apply. Mothers are eligible for equal maternity benefits in cases of birth by surrogacy.

Miscarriage leave

In the event of a miscarriage, you can take up to 6 weeks of leave immediately following the date of the incident.

Additional Maternity Leave

Your health is of top priority to us. In addition to the 26 weeks of maternity leave as described above, mothers are given an option of Additional Maternity Leave - a month long fully paid leave to manage any health complications arising out of pregnancy, delivery, premature birth of child, or miscarriage.

Adoption Leave

In case you adopt a child, Adoption Leave enables you to take time off from work to spend time with your child. You can take 4 months of leave if the child is below 3 years and 2 months of leave if the child is above 3 years. This leave can be availed anytime within the first 6 months of adoption. This leave is available for women employees only. Single mothers are also eligible to avail this leave.

Reduced work hours

Once you have had a baby, and are back to working full-time, you can take off for up to two hours every day for a year from the date of birth of the child in case you need to come in late or leave early to look after the baby. Single parents can also utilize the benefit, up to the time baby is one year old. For women working in shifts and dependent on company transport, the two hours of reduced work hours can be availed as per their requirement. You need to keep your L+1 & HR Business Partner informed.

Extended Maternity Leave

You also have the option of taking extended maternity leave for 3 months to take care of the newborn in continuation with Maternity Leave. However, this leave shall be unpaid.

Paternity Leaves and Benefits:

Paternity Leave

Fathers provide critical support in childcare, especially in the first few days after the birth of a child. You can take 5 days of leave within 3 months of the birth or adoption. You can also opt for reduced work option for 6 months after the birth of your child.

Other Leaves & Benefits

Family Care Leave

At times, the demands of family might come to the forefront and require your undivided attention such as in the case of medical emergencies in the family, or childcare related issues or health problems that require your attention, we give the provision of family leave care.

You can take off for a period ranging between 3 to 12 months if you have been with the company for at least a year.

This leave is separate from the general leave entitlement and must be applied for separately. You will retain your employment and insurance under this leave but will not receive salaries or be covered under other benefits. We would try our best to accommodate your request for family care leave, however, there may be situations where due to the nature of work we may not be able to grant this leave and hold your position vacant for the period of leave. Your HR Business Partners can assist you identify the alternatives.

The decision to grant this leave would be taken by your L+1 in consultation with your MC-1 with and your HR Business partner. You can use the portal for putting in the request via ihub 2.0: All Apps -> Self Service -> Leave Request

Compassionate Leaves

In the unfortunate event of a death of an immediate family member, you may take 5 days of paid leave. Family for the purpose of this section includes parents, in-laws , siblings, partners and children. The leave may be taken within 1 month of the event and in one continuous period. This leave cannot be encashed or deferred.

Compassionate leave can be applied for on the portal: the path in ihub 2.0 is: All Apps -> Self Service -> Leave Request . This needs to be approved by your L+1.

Sabbatical

If you wish to take a longer period of time off from work to pursue education, you can opt for a sabbatical if you have been on the company roll for at least 2 years. Sabbatical provision lasts from 3 to 12 months based on the needs that you may have and on the Company's ability to accommodate the need.

Under the sabbatical, your employment and insurance are retained but other benefits do not apply. The minimum gap between two sabbaticals needs be at least 2 years. Approval of relevant MC-1 is needed in consultation with your HR Business Partner for availing sabbatical leave. To apply, simply log on to the portal and go to:

All Apps -> Self Service -> Leave Request

Marriage Leave

Marriages are made in heaven, but ceremonies happen on earth. You may take 5 days of paid leave to celebrate your marriage. This leave needs to be taken within 1 month of the wedding date and in one continuous period. Marriage leave cannot be encashed or deferred.

Marriage leave can be applied for on the portal: the path in ihub2.0 is: All Apps -> Self Service -> Leave Request. This needs to be approved by your L+1

Managing Needs: Flexi Hours, Part time and more

We will never hold you back in your career if you have important family / medical problems to take care of. To the extent that we can, you are provided with options to manage and plan your work schedule through stay at home options and flexible hours . You are expected to work for 8 hours for every workday (excluding breaks), the following accommodations are available to be made by you to balance your work and life effectively.

Work from Home

In cases of personal exigencies such as ill health of self or child, elderly care and extreme weather- you can take the option of Work from Home . You may 'Work from Home' in situations of personal exigency with L+1 agreement and if the nature of your work permits (ie non-plant and non-client facing roles). You are however, required to be available on call/MS Teams to ensure that your work does not suffer. .

If you're a new parent and the nature of work assigned to you is such that you may work from home, you may do so after availing the maternity/paternity benefit and for such period and on such conditions as you and your L+1 may mutually agree.

You are required to update your L+1 by applying on the portal for the same. The path is, All Apps->Self Service->Attendance and Leaves choose the Work from Home option.

Flexi Hours

If you can't make it on time, then work outside it. If you are not assigned to any particular shift, you can plan your work timings to suit your personal commitments. The core hours for work are from 11 AM to 4 PM, during this time you are expected to be available physically in office. The flexi-hours need to be agreed with your L+1 in discussion with HRBP. There's no reduction in the number of working hours expected from you.

Part Time Work

We understand that at times, you may not be able to commit to full time work. To help you, we have a 'Part Time Work' facility available for you for up to one year under this option you would be required to work for 50% of the time (5 hours per workday including breaks).

Your leaves and salary would be adjusted proportionately for the period on part time work. To be able to effectively contribute on this arrangement a familiarity with the organization is necessary, we insist on a minimum tenure of 1 year before you can consider this option. For women employees there are two more options available.

You may choose to work for 75% of the time (7 hours per workday including breaks). Or choose to restrict your work week to 4 days (8 hours per workday excluding breaks). Your leaves and salary shall be adjusted to 75% and 80% respectively in these two options. During this period your medical and insurance cover shall remain unchanged. Leave encashment and Gratuity shall happen on full basic salary. You would be eligible to consider part-time working option 1 year after your return from your previous part-time work arrangement.

The decision to grant this work arrangement would be taken by your L+1 in consultation with your MC-1 and your HR Business partner. You can use the portal for putting in the request via: All Apps -> Self Service -> Leave Request

Upon approval of the leave a letter will be issued to you mentioning the start date of your part time arrangement outlining your modified terms and conditions of employment by your HR Business Partner

Child Care Benefits:

Creche Facility

When you decide to join back full-time, the company gives the choice to bring your child to work and use the crèche facility to take care of your child as you work.

Salary Benefits

Salary Benefits

Leave Travel Allowance (LTA)

Travel helps you break the routine of day to day work. We facilitate your travels by giving you a tax break on your travel bills. LTA is a component of your fixed TCC and is paid out to you monthly.

You can claim exempt taxion on the LTA amount for that year by submitting the travel expense bills for you and your dependent family in accordance with the Income Tax Act. You can avail a tax exemption on LTA only twice in a block of four years (pre-defined by income tax rules) . You need to take leave for at least one working day and should be traveling during that period to claim a tax benefit on your LTA. LTA is applicable for all economy air and rail fares within India. International travel doesn't get covered under LTA tax exemptions. Family members for the purpose of LTA include your spouse, children, dependent parents and dependent siblings.

You need to fill the LTA Exemption form through All apps>Self Service>Finance>LTA Exemptions and submit the hard copies of tickets through courier to the EST

Car Lease Policy

Our car lease policy makes it easy for you to have a car for both personal and official use. This policy is applicable for all employees in band B, G, Y, O, R. The car will be given to you through a third party service provider ie Fleet Management Companies (FMCs), who provide responsive end to end facilitation of vehicle lease , maintenance and insurance - so that you can drive comfortably without worrying. You can take only one company leased car at a time.

You can choose your vehicle and tenure of the lease (from the given options) based on your annual car lease entitlement, which is 17.5% of your Total Fixed salary or 21.21% of your fixed TCC as per your appointment letter (up to a maximum of ₹20,00,000 per annum). We have an official lease agreement with the FMC to monitor the smooth running of the scheme.

2.1 Leasing Options

You can opt for a lease period of 3, 4, or 5 years. You have two options of lease - Partial lease service and Full lease service .

Under Partial service lease, the following services are offered by the FMC:

- Vehicle selection: The FMC assists you in vehicle selection and also arranges for test drives.

- Car service administration: The FMC will supervise and administer servicing / repairs of the car leased to you. Please note that the servicing and repair costs are borne by you.

- Insurance management: The FMC administers insurance and claim management for your leased vehicle and provides a cashless service at all FMC-authorized locations.

- Partial Damage loss waiver (Accident Depreciation Cover): In case of any damage to the vehicle, the difference between the amount the authorized workshop charges and the amount the insurance company actually settles is borne by the FMC. This service will not be applicable in case of total loss of the vehicle, theft or if the insurance company declares the claim invalid.

- 24-hour Breakdown Assistance: Tow services are a phone call away in locations where the FMC has this service.

Under Full Lease Service, in addition to the services mentioned above, it covers:

- Full service and maintenance of the car . Also included is a door-to-door service for maintenance and servicing in which the car is picked up and delivered at your doorstep, subject to city limits.

There will be an additional cost for these services, which will be built into the lease itself and shall be borne by you.

During the duration of the lease, the respective FMC which gives you the car will be the legal owner of the car and Dr. Reddy's will be the lessee based on the vehicle lease contract. The registration, road taxes and insurance charges are borne by Dr. Reddy's but regular checkups of the car, pollution certifications etc. are your responsibility.

To get yourself enrolled in the car lease policy, give the car lease form to the Corporate Administration team who will connect you to FMC representative and help you execute the lease once you have chosen your car and lease tenure. The Corporate Administration Team will also take you through the various lease plans and help you choose according to your needs.

2.2 Ownership at the end of the lease term

You may grow to love your car and want to purchase it at the end of your lease. You may do so in two ways. Under the market residual value scheme , you have the option to purchase the vehicle at the end of the lease term at the market value of that vehicle. Under the fixed residual value scheme , you have the option to purchase the vehicle at the end of the lease term at a value fixed at the start of the lease term.

Premature Termination of Lease

You have the option of terminating the lease before the lease end date. The foreclosure procedure comprises paying the outstanding book value and VAT along with a penalty charge. You can then take possession of the car.

If you do not want to take possession of the car, you can do so by paying the difference between the outstanding book value, penalty charge and the market value (price at which the car is sold to another party) realized by the FMC.

Most cars won't fly, so when you're posted abroad, your car lease will end. When you are being relocated internationally within Dr. Reddy's, then the lease has to be terminated prematurely and the company will pay the difference between the outstanding book value, penalty charge and market value.

Fuel and Maintenance Allowance (F&M)

We encourage employees to stay close to their place of work and use healthy /eco-friendly means of commute such as walking and cycling. However, for those of us who must use motor vehicles to reach work, we have a fuel and maintenance allowance to prevent fuel costs from burning holes into our pockets!

This can be used for motor vehicles owned by the company or the employee as long as they are used for the intended purpose of official commute.

The allowance is paid out along with your monthly salary for bands V, I, B and G. However, utilization may vary from employee to employee and hence in order to help us compute your income tax accurately, you will need to submit the fuel and maintenance bills towards expenses incurred by you.

Also, do share the good news of you acquiring a motor vehicle with us by submitting RC copy of the vehicle (registered in your name) to EST and we shall be waiting to receive the bills from you.

For bands Y, O and R, utilization shall vary based on roles and hence there is no F&M allowance applicable, however, expenses towards F&M are reimbursed against actuals. Fuel expense bills aren't required to be submitted if the payment is made via the corporate credit card, instead, just create the expenses statement on TRAFORM for fuel expenses and submit the same on TRAFORM. Details of your F&M benefits are given as follows:

| Band | Fuel & Maintenance in ₹ per annum | Driver Salary in ₹ (part of Fixed TCC) |

| V,I * | Up to 42,000 | N.A. |

| B,G* | Up to 1,08,000 | N.A. |

| Y,O,R** | On actuals | 240,000 |

Salary Advance Option

In cases of a personal exigencies in which you need money urgently, you can apply for a salary advance at any time . We allow employees to take a month's gross as an advance but the taxes as applicable will be borne by the employees themselves. To avoid inconvenience, the advance is credited along with that month's salary and not given in cash. If you're a new employee, you can take the advance immediately after joining.

4.1 Applying for a Salary Advance

You need to fill the salary advance form and get it approved by your L+1. If you're an MC-1 member or MC member, then only self-approval is required. The approval needs to be routed through the Employee Service Team (EST) via the EST drop box at your office to be processed.

4.2 Repaying the advance

You can return the advance over a maximum of six equal, interest free, monthly installations. You just have to choose the number of installations you are comfortable with and the amount will get deducted from your salary automatically. You can take the advance again after a six month gap of the date of completely repaying the previous advance taken. For employees who'd be leaving us with any outstanding advance amount, the balance shall be adjusted in your final settlement.

Only permanent employees of SVAAS Wellness.

Salary advance will not be processed if their latest month's payroll is locked.

The salary advance credit cycle runs twice a week.

In case you are a Key Management Personnel, additional necessary approvals will be required.

Components of salary which are paid monthly

Career Development

Career Development

To help you learn and prepare for future growth, we offer a range of learning and development opportunities. While most of this happens on-the-job, you also have several options for learning, developing functional expertise, enhancing your soft skills, realizing your leadership potential and much more.

Coming on Board: Induction, Training and Confirmation

At SVAAS Wellness. we take our training processes very seriously for our fresh hires and laterals. The first few months are critical for your growth in the company and we strive to provide you with the best training and induction into the business.

1.1 Induction: First Steps

We work together to ensure that your initial days with us are very special. Your induction will introduce you to different aspects of the Company post which you will move into the business unit and take on the responsibilities of your role.

At Leadership Academy (LA) – our state of the art learning facility you will have access to great teachers and custom made curriculum. At LA, you'll be given an immersive experience of the pharmaceutical industry and a chance to acclimatize to the work systems, processes, and cultural values that set us apart from any other company. Our top business leaders will interact with you and share their experiences with you, so that you are able to create your niche within the company.

1.2 Training

Fresh campus hires or those with less than a year of experience are typically hired as trainees based on internal norms. The training period is customized according to your qualification and experience. In cases of poor performance, the L+1 in consultation with the HR Business partner may choose to give you an extension of the training period, with the extension period lasting anywhere between from 3 to 6 months. Written deliverables are typically given to focus and aid your evaluation during this period.

A cut-off of the 15th of a month is used for calculating the end of your training period. For those joining post 15th of the month, the 1st of the next month will be considered as the end date.

1.3 Confirmation

Post training, your performance will be evaluated by your L+2. If your L+1 is a part of MC-1 or is an MC member, the evaluation shall be done by your L+1 directly. If your performance during the training period is satisfactory then you'll be confirmed as a permanent employee. If you were on training extension, a fresh evaluation and assessment is carried out, post extension period.

Upon confirmation your salary may be revised according to the training to confirmation increment matrix. If you're eligible, pro-rated variable pay will be paid to you.

Capability Building

We encourage you to discuss your learning priorities with your L+1 and the HR Business Partner so that your individual development needs and organizational requirements in agreement. There are multiple options for self-development as outlined below.

You may continue your learning by becoming members of reputed professional associations. You can apply for a membership to a professional body by filling up an application in consultation with your HR Business Partner.

2.1 Organizational Training Programs

The organization will periodically arrange training programs based on need and interest. . In addition to this, you will have access to various skill building /career transition programs that are floated through the year. You can browse these offerings on ihub. We also develop customized learning programs for various groups based on specific business imperatives.

3.Higher Education Support

You can apply for Higher Education courses related to your area of work and the organization will reimburse your fee within reasonable limits. Reimbursement grants are considered after approval only for courses from reputed institutes and should be linked to your area of work. Have a conversation with your L+1 and HR Business partner for more information.

3.1 Applying for Higher Education beyond company tie-ups:

Unless you are applying for a PhD, which may last for more than four years, the duration of courses that we consider for support should typically not exceed three years .

You may initiate the process by discussing it with your L+1 and the HR Business Partner, giving them details of the course and filling in the Higher Education Scheme application form. Your relevant MC-1 and your HR Business Partner will evaluate the request and may recommend your application to L&D to evaluate. Once approved by the L&D team, you can go ahead with the course after submitting the approval to your HR facilitator. You can claim the agreed compensation once you complete the course.

3.2 Planning Ahead:

You can pursue only one course at a time to be able to balance your professional work with course demands. You should share the examination schedule with your L+1 well in advance and plan your leaves accordingly. You are responsible for all other arrangements including preparation time, travel and any other requirements to complete the course successfully.

3.3 Claiming Reimbursement

Once you complete the approved course you can apply for a fee reimbursement by filling up the Higher Education-Reimbursement form . Reimbursements may cover your expenses on admission fee, tuition fee, course material and examination fee against proof of expenses. Your application for reimbursement of course fees should be approved by your and the relevant MC-1 member. The approval needs to be sent to the Employee Services Team along with original bills and the approval you received from the L&D team before commencing the course. This reimbursement support is likely to attract Perquisite Tax, which you will have to bear.

3.4 Service co mmitment post reimbursement

Once your study expenses have been reimbursed by the company, it is expected that you serve the organization for at least three years after the completion of the course. If you choose to separate from the organization before that, you can do so by repaying the reimbursement as per the following criteria:

| Separation period from claim date | Amount to be paid by employee |

| Before completion of 12 months | 100% of the reimbursement amount |

| 12-24 months | 75% of the reimbursement amount |

| 24-36 months | 50% of the reimbursement amount |

| After completion of 36 months | Nil |

4.Internal Job Transition

If you have completed 2 years in a role, then you have the chance to explore other opportunities on offer in SVAAS Wellness Ltd or in the parent organization – Dr.Reddy's.

A variety of roles are advertised on the career center with information about internal opportunities and postings. Job descriptions are given along with the relevant qualifications and if you're interested, you can apply via the job postings.

You can use the portal to apply by searching for Current Openings in ihub 2.0.

You can also give your resume to the Talent Acquisition Team citing the position. Your L+1 must be informed about the application, but beyond that, your confidentiality shall be maintained.

4.1 Evaluation and selection

If you're selected for the position applied for, then you'll need to confirm your acceptance within three days, or it will be automatically considered as an acceptance.

While the declining offer you applied for, you should keep in mind that you'd be considered ineligible for future job opportunities for one more year.

Transition

The release of the employee for transition from one role to another should take place within 2 months.

4.3 Company Initiated Movement

To cater best to the needs and potential of our employees, the HR tracks the employees who've completed 4-5 years in a role and are ready for job rotation. Your job rotation will be facilitated to allow the best utilization of your talent and company's needs.

In addition to this, the company regularly floats growth programs which you can choose to apply for.

Promotion & Progression Policy

SVAAS Wellness talent management philosophy is to nurture and develop our talent to build a leadership pipeline. This requires us to take informed decisions on internal talent when deemed 70-80% ready. This is done in line with organizational needs.

A Promotion will occur when an individual changes role and moves from a role at a lower band to a role at higher band. Progression on the other hand will occur when an individual moves across sub-bands.

As per our Employee Movement Policy, Promotion shall be based on panel assessment of the ideal profile, comprising functional & leadership competencies (ASPIRE) along with must-have experience required for the role. Promotion is an on-going process throughout the year and may occur under the following scenarios:

- Vacant position at a higher band filled by suitable employee at a lower band

- New position at a higher band, filled by a suitable employee at a lower band

Progression occurs once a year in Oct and may occur under the following scenarios:

- Employee acquires new/higher level skills or qualifications relevant for the current role

- Scope of employee's current role has moderately increased. This may be demonstrated by handling relatively higher responsibilities and handling assignments of relatively greater complexity.

Minimum (but not limited) eligibility criteria for employee movement includes:

- Proven performance record for 2 years (Average Rating > 1.0)

- Tenure of at least 2 years in the current role.

You may reach out to your BU HR Partners for further details.

Long Service Recognition

It's a special time for you and for us when you finish an enthralling tenure with Dr. Reddy's or SVAAS Wellness Limited. At key milestones of your career, you'll find a small gesture of our appreciation for your continued service given to you. The amounts will be credited to your accounts in the same month in which you finish your milestone. The amounts will be as follows:

| Milestone in Years | Cash Awards for employees in Violet Band | Cash Awards for employees in other Bands |

| 5 | INR 2,000 | INR 5,000 |

| 10 | INR 4,000 | INR 10,000 |

| 15 | INR 6,000 | INR 15,000 |

| 20 | INR 8,000 | INR 20,000 |

| 25 & Above | INR 10,000 | INR 25,000 |

Note:

If you are in the role of Head – Sales or Head – Sales & Marketing in GG India HO, please refer the benefits and policies applicable to band Green.

If you are in the role of Commercial Head in GG India HO, please refer the benefits and policies applicable to band Yellow.

Business Enablers

Business Enablers

DOMESTIC TRAVEL

While we encourage you to make use of digital services such as VC / Microsoft Teams for work, you might have to travel sometimes. On such occasions, we encourage you to be environmentally-conscious and prudent in your choices. The given enablers will comfortably cover your need based expenses, at all times while deciding on any of the aspects of travel, we would advise you to spend as if it were your own money and always act in the best interest of the organization.

While planning your travel, do inform and discuss with your L+1 before logging in a travel request to the travel desk to book your tickets and accommodation.

Inter-city Travel

Travel within 60km from your office location is considered within the purview of 'local conveyance', and any travel beyond 60km comes under 'domestic travel'.

Generally, all employees are eligible for air travel in economy class if the travel time is exceeding 6 hours by road or rail. For travel time less than 6 hours by rail or road, you'll be eligible for AC tier 2 travel. Train tickets need to be purchased by you directly and reimbursed. For safety reasons we do not support traveling by car or any private transport. If flights/trains are not available, we advise you to use safe and comfortable bus travel from reputed operators.

Travel requests will have to be reviewed by your L+1 at band G, Y,O or R. For greater flexibility, employees in bands G, Y, O and R can self-approve the travel requests. Travel request approval mechanism will remain the same when you are raising a request for a guest traveler. To help you take informed decisions based on travel budgets, the Finance team will aid you with travel dashboards while approving the request (for self or others).

Food and Accommodation

While undertaking domestic travel, you may either opt for Company provided accommodation or choose to make your own arrangements for accommodation (Self-Accommodation).

Company-provided Accommodation

The Company maintains several guesthouses and has also partnered with hotels in various cities to help address your travel needs.

Company guest houses are the recommended accommodation where available. Where guesthouses are not available, you should stay at our partner hotels. In rare situations where there are no guesthouses or partner hotels in your city of work, you may book an accommodation directly and get it reimbursed within the limits mentioned below.

Please find below the entitlement grid for hotel limits (applicable in either case – if booked through transit accommodation or if booked directly by you):

| In case of Company provided Accommodation | In case of self-arranged Accommodation | ||||||

| Accommodation Limits | Meals Limits | Per diem limits | |||||

| Category | Class A | Class B | Class A | Class B | Class A | Class B | |

| R,O | Actuals | Actuals | Actuals | Actuals | 5,500 | 4,000 | |

| Y | 10,000 | 6,000 | 2,250 | 1,500 | 5,000 | 3,000 | |

| B,G | 7,500 | 5,000 | 1,750 | 1,250 | 3,750 | 2,500 | |

| V, I | 4,500 | 3,500 | 1,000 | 600 | 2,250 | 1,750 | |

| Class A | Class B | ||||||

| Chennai, Delhi NCR, Mumbai, Kolkata, Bangalore, Pune | All other cities | ||||||

*Accommodation limits are excluding taxes

Please note that the above grid is not applicable for Visakhapatnam and Hyderabad, in which case the Transit team will help you with suitable accommodation (Leadership Academy, Guest Houses or Hotels with preferred tie-ups) Any exception in

limits shall require approval from the respective L+1 in bands G, Y, O or R.

Self-Accommodation

Alternatively, you can choose to make your own arrangements for accommodation (such as staying with friends, family or staying at a B&B or hostel) and claim the per diem amount. The Per Diem is to be used towards meeting accommodation, food and incidental expenses. No supporting bills need to be submitted for claiming the Per Diem.

Per Diem eligibility is based on the classification of the trip – i) Single day trip ii) Multiday trip

Single Day Trip: If you initiate and close your trip on the same day without any overnight stay, you shall be eligible for the full Per Diem.

Multiday Trip : You shall be eligible for the full Per Diem on travel days requiring overnight stay. On the day of return, you shall only be entitled to Per Diem if your departure is after 12 PM. If your departure is before 12 PM, then you are entitled to 25% of the regular Per Diem amount.

Traveling with a senior colleague

When you are traveling with a senior colleague and both of you opt for company provided accommodation, your entitlements for meals and accommodation will be the same as theirs.

Other expenses

You can claim expenses such as tips, portage, official phone calls and use of business centers, whenever incurred. They can be filed under the Incidentals category. You can claim laundry expenses if your trip is for more than four days .

Expenses on cigarettes and alcohol: We do not support such expenses unless incurred while entertaining external business guests. These expenses need approvals from MC-1. Details of such expenses including the names and organizations of the business employees entertained should be a part of your reimbursement statement.

Out-of-pocket expenses: which may not have formal bills or receipts, need an explanation from you to be approved.

Intra-city Travel

When traveling outside base location, you should use App based cab options for conveyance; company-booked cabs will be provided in case such options are not available. En-route expenses you incur while traveling for work related reasons will be reimbursed reasonably against bills.

If your role band is V or I- you'll need an approval from your L+1 at role-band B,G,Y,O or R . For others, it is self-approved .

If you have a company car, please use it for local commute instead of hiring cabs. If you are using your own car or the company-provided car for local commutes, we will reimburse costs @ Rs 15.00 per km effective date is 1st January 2022,while for use of two wheelers you can claim @ Rs 4.50 per km.

While the closing trip, please provide complete details of the places visited, the starting and closing time, the closing reading of the odometer and sign the ledger/ slip available with the chauffeur before you relieve the vehicle.

Corporate Credit Card

You can use your corporate credit card for all expenses. If you do not have a corporate credit card, you can request for a travel advance up to ₹10,000/- when you raise a travel request via portal. If your tour takes you to an area which may not easily accept credit cards, you may ask for a travel advance even if you have a corporate credit card.

Booking for Travel and Accommodation:

The Travel Desks will take care of your travel and accommodation requirements. Even if you make arrangements on your own in certain cases, such bookings need to be updated in your trip report for you to claim for reimbursement.

You need to raise a travel request through the portal. You can search for the app “Travel Request and Expenses” in ihub 2.0 .

You can contact the travel desk at the following addresses:

[email protected] for domestic travel, [email protected] for hotel and guest house bookings.

Travel desk does not take care of Rail bookings and this has to be booked by you. You can later claim compensation on the same.

Claiming expenses

You can submit claims via the expense report option on the portal. The path is: All apps->You can search for the app “Travel Request and Expenses. ” on ihub 2.0.

Whether you have taken a travel advance or are using the corporate credit card, please clarify your expenses in the expense statement and submit it with original bills, receipts, and the credit card statement to the Global Business Services (GBS) within 15 working days of your return from a tour, or before you leave for another tour, whichever is earlier. You can reach GBS at [email protected]

You can submit requisitions through two channels:

| Green Channel: Fast Track, self-approved reimbursements without scrutiny |

Red Channel: Approval required prior to reimbursements |

| Travel expense statements can be routed through this channel if your travel is pre-approved and your claims are within entitlement limits , and supported with bills and receipts. | 1. If your travel/tour is not pre-approved. 2. If your expenses have crossed entitlement limits. 3. Other reimbursement claims that are not supported by bills. 4. All international travel. 5. Reimbursement of business calls made from a personal phone. |

The option of choosing the channel for reimbursement is self-governed by the employee and therefore extra care needs to be taken while making the selection. In case of doubt please speak to your L+1 or select Red Channel to ensure appropriate checks are done.

Cancellation

To initiate the process of cancellation you need to send an e-mail to [email protected] . In case you have booked your ticket through the Self Booking Tool, you will need to cancel the booking by selecting the appropriate option available on the tool.

INTERNATIONAL TRAVEL

With Dr. Reddy's extending its promise of good health globally, you might have to travel to other countries for work. Your travel will be facilitated by the International Travel Desk which can be reached at [email protected] . You can requisition travel via the portal - just look for “Travel Request” in ihub2.0

Accommodation

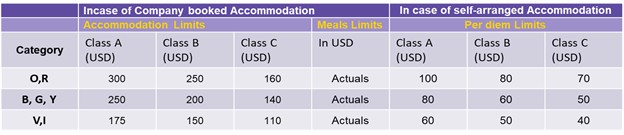

Company-booked Accommodation

We would book you in a comfortable hotel at the location of travel. This would be done in accordance to the hotel limits mentioned in the table below.

Self-Accommodation (Daily Entitlements):

You may choose to stay with friends or family or make your own arrangements for stay, in such cases you are entitled to a Per Diem to cover expenses towards accommodation, food and incidental expenses. No supporting bills need to be submitted for claiming the Per Diem. However, you will need to sign a declaration to claim this allowance.

However, in case the duration of stay is beyond 15 days, company provided accommodation will be binding on employees and per diem will be applicable in the below conditions only:

- If company provided accommodation is not available

- In case respective MC member approves self-accommodation as an exception

Per Diem eligibility is based on the classification of the trip

Single Day Trip: If you initiate and close your trip on the same day without any overnight stay, you shall be eligible for the full Per Diem.

Multiday Trip: You shall be eligible for the full Per Diem on travel days requiring overnight stay. On the day of return, you shall only be entitled to Per Diem if your departure is after 12 PM and at 25% of the regular Per Diem amount.

Details of the entitlements, according to countries are given as follows:

![]()

Note: The hotel limits are excluding taxes

Air Travel

The below grid outlines the recommendation for travel class when you are travelling internationally. The recommended class of travel shall in no way be considered to be an entitlement.

Duration |

Mode |

| O, R | Business class |

| G, Y | Business class if the journey time is more than 6 hrs |

| V, I, B | Economy class |

The recommended class of travel may be altered by the approving MC member based on their assessment of the purpose of travel, customer meetings vs internal reviews, attending seminars vs presenting papers, whether the planned trip has buffer days in addition to the actual days needed for the purpose of travel.

The alternation can be done by the MC member both as an upgrade or lowering of the class of travel from the suggested mode.

The following scenarios would result in tickets being issued in economy class (applies to all employees except MC members):

- Any overseas travel undertaken for skill/knowledge development

- Any overseas travel approved less than 7 days in advance

Expenses

We trust you to spend reasonably as if it were your own money and spend in the best interest of the company.

Daily E xpenses such as local conveyance, food, tips and portage, airport arrival and departure taxes, visa charges, excess baggage charges, laundry, international telephone calls, entertainment of guests, medical expenses, expenses on self-driven cars or on taxis can be claimed on actuals with relevant bills, vouchers and cash memos.

You will be given a corporate credit card for daily expenses. If required, you can request for a cash advance of up to US$ 1,000 to meet reasonable incidental cash requirements through the travel team.

In cases where you have to stay at a location for over two weeks, you are entitled to a weekly allowance of US$ 75 to meet your out-of-pocket living expenses. You will need to sign a declaration to claim this allowance. Please restrict special corporate gifting , entertainment and liquor expenses to customer interactions. Ideally, when you plan your international tours, do anticipate such occasions and have them cleared in advance with the relevant MC members. For any exceptions in Expenses, please discuss with your relevant MC-1 member for approval. In cases where you have to go for VISA processing before the trip request is raised/approve, MC-1 approval would be required for it.

Travel Insurance

You will be covered by travel insurance if you are traveling abroad for the company.

Heaven forbid, if a situation does arise to claim insurance, the policy covers Accidental Death, Permanent Disablement, Emergency Medical Expenses, Loss of Baggage and Personal Documents, Checked-in Baggage Loss, Baggage Delay, Emergency Travel Benefits, Personal Liability, Hijacking, etc. Further details are outlined in the travel insurance certificate. Coverage terms and conditions are shared with you by the Travel Desk coordinator before you leave.

Travel Approvals

Your international travel requisition needs to be approved by an MC member from your function/BU. While submitting expenses relating to international travel (within the limits of the policy), approval of relevant MC-1 member is needed. In case of any deviation, approval of MC members will be required. You can request for an advance when you raise your travel requisition.

Claiming international expenses

Please submit your claim within 15 working days after returning from a trip. The travel expense statement is on the portal - just search for “Travel Request & Expenses” in ihub2.0

This expense statement has to be filled and submitted with original bills, credit card statements and receipts via the Red Channel since it needs approvals from L+1s as per the Delegation of Authority guidelines.

If you have taken travel advance, you may wish to return the foreign exchange, this can be done only for US$, £, and €. If you are returning from a country which uses some other currency, please exchange the local currency into any of the above before you leave that country.

Cancellation

To initiate the process of cancellation you need to send an e-mail to [email protected]. In case you have booked your ticket through the Self Booking Tool, you will need to cancel the booking by selecting the appropriate option available on the tool.

CORPORATE CREDIT CARD

At Dr. Reddy’s we trust our employees to spend company money when it is required for company related expenses. To facilitate cash flow, the corporate credit card is available to all employees, across bands. The limits for each individual is decided by the finance team based on parameters such as frequency and duration of travel, nature of work and interactions with external stakeholders. You are expected to use the credit card as responsibly as you would when spending your own money.

To enroll for the card, simply fill in your details in the credit card application available with the HR Business partner and submit the requisite proofs in hard copy. If any problem comes up then you can reach out to the company’s Corporate Credit Card Administrator at [email protected].

Broad Guidelines- Trust But Verify

The company trusts its employees to not use the credit card for personal expenses but we do verify. In a situation where the card gets used for non-work expenses, we will have to withdraw the card.

Monthly statements of your expenses will be shared with you which along with the original bills are to be approved by a L+1 as per the Delegation of Authority guidelines. Share the same with the Corporate Credit Card Administrator to release the payment to the service provider.

At the time of separation from the company you will need to return the corporate credit card to the Corporate Credit Card Administrator with all the outstanding dues cleared, else the outstanding amount will get adjusted to your final settlement.

The details regarding which expenses are allowed can be found in the travel enablers guidelines.

DOMESTIC RELOCATION

Your job may require you to shift your base to another Dr. Reddy’s location to do the same role or take up a different one. In such scenarios, we would extend all possible support to make the transition comfortable.

Travel Support

We will reimburse a one-time travel cost for your family members—spouse, dependent children and dependent parents—from your current location to where you are posted. To help you coordinate the transfer of your family and belongings, you can claim for yourself up to three paid-for single trips.

If you are a trainee, you can get one-time travel cost reimbursement for a maximum of two of your family members. Travel mode shall be as per the domestic travel policy.

If you are based in a city at a driving distance from your posting location then you may travel by car and we will reimburse the travel @ INR 7.00 per km effective date is 1st January 2022.

Packing & transportation of household goods

We encourage you to avail the cashless facility for packing and transportation of your household goods through vendors we have partnered with. For availing this facility, please reach out to [email protected].

To transfer your belongings, the company will bear the charges for packing and transportation according to the following table:

| Role-Band | V, I | B, G, Y | O, R |

| Less than 300 Km | 15,000 | 20,000 | 25,000 |

| 300 to 1000 Km | 30,000 | 40,000 | 45,000 |

| 1000 Km & Above | 45,000 | 55,000 | 60,000 |

You can take up to 70% of your packaging and transportation costs as an advance with the approval of your BU HR Head Keep your invoice handy for the same. For calculation purpose, you will have to present 3 quotations and advance will be given against the lowest quote.

Joining Vehicle transfer

You can claim transportation costs on actuals for one vehicle (four wheeler or two wheeler). We also pay for the inter-state registration, road tax and brokerage charges for one vehicle registered in your name, subject to a maximum amount of INR. 60,000. This amount would be treated in accordance with Income tax rules.

Initial stay

To help support you while you find suitable accommodation for yourself and your family, we will arrange your stay for up to 15 days at the Company guest house or at a hotel. Please reach out to the respective HRBP/HRSS for booking the accommodation.

Relocation Leave

As you will need days off to travel and settle into a new location, you are also eligible for a relocation leave of up to 4 days during your relocation (to be used within 15 days of date of relocation).

Brokerage fee

We reimburse brokerage fees subject to a limit of 50% of the monthly rent of the apartment you choose. In case you are sharing the accommodation with another colleague from Dr. Reddy’s, only one of you can claim the reimbursement. This amount would be treated in accordance with Income tax rules. This amount would be treated in accordance with Income tax rules.

School / College admission fees

We recognize that there can be fresh expenses as you place your children in a new educational institution. We subsidize these expenses up to ₹ 50,000 per child for a maximum of 2 children. The expenses can cover one- time admission fees, cost of books and uniform only. You can claim reimbursements with the approval of your BU HR Head. This amount would be treated in accordance with Income tax rules.

Taxability of Relocation Expenses

Joining expense claims for brokerage fees, vehicle transfer, interstate registration and school, college admission fees are treated as perquisites and are taxable in accordance with the Income tax laws. These taxes will have to be borne by you. In case you place a request to extend your initial stay beyond 15 days, the amount incurred by the company towards extending your accommodation this too shall be treated as a perquisite.

INTERNATIONAL RELOCATION (in case of relocating/repatriating to India)

We acknowledge the effort it takes for a family to relocate to a new country and start afresh. Accordingly, apart from the logistics support of the International Travel Desk ([email protected]) in arranging your travel, we also support you with certain allowances to help you settle into a new environment.

Travel and Transit costs

We arrange Economy/Coach class tickets for your spouse, children and you, as well as secure accommodation during transit as per the International travel accommodation eligibility in case of international relocation.

Initial stay expenses

Once you reach the new India, you will be accommodated for 15 days at a company accommodation or a hotel. In line with the Domestic and the International Travel policy you may claim:

- Boarding and lodging costs

- Local conveyance expenses

- Official telephone calls

- Laundry expenses

Initial Settlement Expenses

You are eligible for lump sum allowances against actual expenses to the extent of total not exceeding 5,000 USD net of taxes based on the number of individual travelling:

- 2,000 USD for self

- 1,500 USD for each accompanying family member

You can use this amount for the purchase of goods and services required to set up an establishment. Alternatively this allowance can be used to cover the costs of transfer of personnel effects from the country of residence to India and other miscellaneous costs that arise due to the transfer subject to a limit of the eligible Allowance.

Relocation leave for expatriates returning to India

You can take up to 5 days of relocation leave, in addition to the time spent on travel. This period will be treated as ‘on duty’ and will be over and above the leave entitlement.

Claiming relocation expenses

All the settlements/reimbursements pertaining to travel, relocation advance and initial stay expenses can be done through the portal. These expenses need to be routed via the Red Channel. You will need to send the expense statement along with the supporting bills and credit card statements to Global Business Services (GBS).

For claiming your Initial Settlement Allowance, you can fill the form and send it with supporting bills with the approval from the concerned MC member in consultation with your HRBP to Global Business Services (GBS).

All travel arrangements and requisitions need prior approval from MC-1/LC member of your function/ business unit and the Head of the unit HR.

Please submit reimbursement/ allowance claims with original bills/ receipts within three months of relocation. If you anticipate a delay, let the HR team at your location know.

MOBILE TELEPHONE, INTERNET & ACCESSORIES

Workplaces are dynamic today and so are you. The corporate SIM connection is there to help you remain connected for all your work related needs. A corporate SIM connection with data facility is provided for all those in supervisory roles and for those in corporate functions. However, if the nature of your work demands it and your L+1 is in agreement with you, , you will be eligible for the corporate SIM connection irrespective of your function. The company will pay the rental, activation and official call charges directly to the service provider.

You can also avail ISD facility by taking approval from your respective MC-1 members. This facility is made available by default to the MC-1/MC members.

If you have a Corporate SIM connection, you will also be able to claim a reimbursement for one mobile instrument once every three years, as per the following grid:

| Employee Group | Maximum Reimbursement (INR) |

| V, I | 3,500 |

| B, G, Y | 10,000 |

| O, R | 25,000 |

You can claim reimbursement of the mobile instrument cost by submitting the Mobile Handset Reimbursement form. Once you hand over the filled-in form with the phone purchase bill to your HR Business Partner, it is routed to the Employee Service Team (EST) for reimbursement which is credited to your account with the following month's salary.

Device Maintenance

The expenses related to upgrades/repairs are required to be borne by you. In case you decide to leave the company within a period of 3 years of claiming reimbursement for the mobile, you’ll have to return the depreciated cost as follows:

| Time period | Deduction |

| Less than 12 Months | 100% |

| Between 12-24 Months | 50% |

| Between 25-36 Months | 25% |

| Beyond 36 Months | 0% |

Joining Support & Referral Policy

Joining Support & Referral Policy

We offer all possible support to welcome you into the or SVAAS Wellness family and make your transition easier. You are eligible for Joining Support if the distance between your current city of work and the joining location are more than 60 km apart.

Travel Support

We will reimburse a one-time travel cost for your family members—spouse, dependent children and dependent parents—from your current location to where you are posted. To help you coordinate the transfer of your family and belongings, you can claim for yourself up to three paid-for single trips. If you’re a trainee, you can get fares for a maximum of two members of your family reimbursed.

The travel mode entitlement for the purpose of above trips are as below:

| Band | Travel Mode |

| V | AC 2 Tier Rail |

| I, B, G, Y, O, R | Economy Class Air Travel for travel duration > 6 hours by rail or roadways |

If you are a trainee, your travel entitlement will be as per the entitlements of the band you are eligible to be confirmed in.

If you are based in a city at a driving distance from your posting location then you may travel by car and we will reimburse the travel @ INR 10.00 per km.

Packing & transportation of household goods

To transfer your belongings, the company will bear the charges for packing and transportation according to the following table against bills:

| Role-Band | V, I | B, G, Y | O, R |

| Less than 300 Km | 15,000 | 20,000 | 25,000 |

| 300 to 1000 Km | 30,000 | 40,000 | 45,000 |

| 1000 Km & Above | 45,000 | 55,000 | 60,000 |

Joining Vehicle transfer

You can claim transportation costs on actuals for one vehicle (four wheeler or two wheeler). We also pay for the inter-state registration, road tax and brokerage charges for one vehicle registered in your name, subject to a maximum amount of ₹ 60,000. This amount would be treated in accordance with Income tax rules.

Initial stay

To help support you while you find suitable accommodation for yourself and your family, we will arrange your stay for up to 15 days at the Company guest house or at a hotel. Your recruitment coordinator would help you with making the bookings. The amount the company spends on initial stay shall be treated in accordance with Income tax rules.

Brokerage fee

We reimburse brokerage fees subject to a limit of 50% of the monthly rent of the apartment you choose. In case you are sharing the accommodation with another colleague from Dr. Reddy’s, only one of you can claim the reimbursement. The brokerage reimbursement shall be made against bills. This amount would be treated in accordance with Income tax rules.

Notice period claims

If we need your services before you complete your notice period at your existing place of work, we shall reimburse any notice period payment you might make to your current employer. The Talent Acquisition Team will, in such cases, discuss the specifics of this with you as part of your pre-joining conversation. This amount would be treated in accordance with Income tax rules.

Taxability of Joining Expenses

Joining expense claims for brokerage fees, vehicle transfer, interstate registration and payments in lieu of your notice period are treated as perquisites and are taxable in accordance with the Income tax laws. These taxes will have to be borne by you. Incase you place a request to extend your initial stay beyond 15 days, the amount incurred by the company towards extending your accommodation too shall be treated as a perquisite.

Claiming joining expenses

You can fill the Joining Expenses Claim Form and submit it with supporting documents to your HR facilitator. The reimbursement will be directly credited to your account. You are expected to claim reimbursements with original bills/receipts within three months of joining.

If you are not able to claim these expenses within 3 months, you can do so within 6 months along with an approval of your HR Business Partner. If you still fail to do so, you can submit these expenses within 12 months with the approval of your BU HR Head. Beyond 12 months, no extensions can be granted.

We recommend that you keep your recruiter and HR business partner informed of the delay to avoid any issues later.

Recovery of Joining Expenses

If you decide to leave your job within 12 months of date of joining, the gross amount of the claim would have to be paid back by you to the company.

Joining Support in case of relocation to India from International Geographies

We acknowledge the effort it takes for a family to relocate to a new country and start afresh.

Travel and transit costs

We arrange Economy/Coach class tickets for your spouse, children and you, as well as secure accommodation during transit as per the International travel accommodation eligibility in case of domestic relocation. Alternatively, we will reimburse the amount spent on tickets.

Initial Settlement Expenses

You are eligible for lump sum allowances against actual expenses to the extent of total not exceeding 5,000 USD net of taxes based on the number of individual travelling:

- 2,000 USD for each new joiner

- 1,500 USD for each accompanying family member, the total not exceeding 5,000 USD net of taxes.

The new joiner can use this amount for the purchase of goods and services required to set up an establishment. Alternatively this allowance can be used to cover the costs of transfer of personnel effects from the country of residence to India and other miscellaneous costs that arise due to the transfer subject to a limit of the eligible Allowance. The receipts and bills against such expenses needs to be submitted for reimbursement within the above defined limits.

Since international hiring is done on a selective basis mostly for critical positions, all such relocations should be processed with the approval from the concerned MC member.

Initial stay expenses

Once you reach India, you will be accommodated for 15 days at a company accommodation or a hotel. In line with the Domestic and the International Travel policy you may claim:

- Boarding and lodging costs

- Local conveyance expenses

- Official telephone calls

- Laundry expenses

Claiming relocation expenses

All the settlements/reimbursements pertaining to travel, relocation advance and initial stay expenses can be done through the portal. These expenses need to be routed via the Red Channel. You will need to send the expense statement along with the supporting bills and credit card statements to Global Business Services (GBS).

For claiming your Initial Settlement Allowance, you can fill the form and send it with supporting bills with the approval from the concerned MC member in consultation with your HRBP to Global Business Services (GBS).

All travel arrangements and requisitions need prior approval from MC-1/LC member of your function/ business unit and the Head of the unit HR.

Please submit reimbursement/ allowance claims with original bills/ receipts within three months of relocation. If you anticipate a delay, let the HR team at your location know.

Referral Policy

We believe that you are an ambassadors of our culture and hence you can refer a candidate best suited to our environment. Our Buddy Referral Scheme – Parichay - invites you to refer friends and acquaintances for job openings within the company. If the person you have referred is selected, then you will be rewarded for your efforts.

Employees across role-bands, whether confirmed or in training, can refer candidates and be awarded on candidate selection.

Those who are not eligible to receive awards but can make referrals are employees in Human Resources, managers involved in the selection process, those to whom the occupant of the open position will report, and those at role-bands Y, O, or R.

Making a referral

Job vacancies are posted on the Career Centre section of the portal and on the external website. If you know of a candidate who fits thejob profile advertised, you can make a recommendation at: careers.drreddys.com or by sharing related details with Talent Acquisition Team member/ HR Facilitator.

Awards on successful selection

If the person you referred for a position is selected by the company, you will become eligible for a financial reward subject to relevant income taxes once the referred employee completes 3* months with or SVAAS Wellness. The reward is based on the role for which the candidate has been selected:

| Role | Referral award ₹ | Diversity Bonus |

| Territory Manager, TM Manufacturing, TM Production, TM QC, TM QA, TM Engineering, TM Ware House | 10,000 | 5,000 |

| Territory Business Manager, ABM, KAM, ASM, RSM, TM AR&D, TM FR&D, Finance Associate | 15,000 | 7,500 |

This reward is not given for recommending ex- or SVAAS Wellness employees.

For all other roles, we have the following grid for rewards based on the hiring band of the successful candidate:

| Band | Referral award INR | Diversity Bonus |

| V,I | 12,500 | 6,000 |

| B, G | 25,000 | 15,000 |

Diversity Bonus enables Dr. Reddy’s to be a richer, more vibrant organisation and therefore you are paid an additional bonus if the successful candidate is a woman, LGBTQ or differently abled.

Since our employees are the brand ambassadors of the organization, we allow them to refer any close relative/spouse for any job opening. The rewards conditions will be similar as stated above. You can refer 2 relatives per year and confirmation of any one relative will automatically negate the second referral option for that year.

Payment of Referral Amount

Once your candidate is selected, the Talent Acquisition Team (TAT) facilitator will let you know. You can fill up the referral form available and send it to the facilitator for approval by the TAT Head.

You @ SVAAS Wellness

You @ SVAAS Wellness

The Exit Process

If you have decided to separate from the organization, the process of resignation is as follows: you submit your resignation to your L+1 either via a hard copy letter or online through the portal. The path is : All Apps->Resignation

Once the resignation is accepted, it is forwarded to the HR facilitator concerned. You will receive an acknowledgment along with the relieving date, which will be decided keeping in view the nature of responsibilities that you handle.

For all confirmed employees, the notice period is 3 months (calendar days). For Trainees, it is one month. The actual relieving date before the completion of the notice period will, however, be the prerogative of the organization.

The Exit Interview and After

There will be an exit interview where you may share your thoughts, reasons for leaving and concerns in a free and frank manner. Your feedback will help us improve.

After the exit interview, you will settle all dues by filling up the ' No dues Certificate' and getting it cleared by your L+1, Finance, HR and other relevant functions for your final settlement.

All job-related responsibilities, assignments, organization assets and infrastructure-related materials need to be handed over to the L+1 and HR facilitator before leaving the company.

Insured Benefits

Insured Benefits

Group Mediclaim Policy for Employees

The Health Insurance policy (Group Mediclaim) which covers workers and employees of SVAAS Wellness Limited a and their family members for the period from 1st September 2023 to 31st August 2024 has been renewed with Go Digit Insurers for the Base & Top-Up policy.

Medi Assist will continue as the TPA for our policies. Medi Assist will guide and assist the employees during the process of hospitalization and claims reimbursement.

E-cards for employees and the covered family members will be available on the same portal post 7 days of closure of enrolment process. Cards will also be available on the application "Medi Buddy" that can be downloaded on your phone. In the interim period, the Employee ID Cards with authorization letter from Unit HR are valid and will be accepted by the network hospitals for providing cashless treatment.

Enrolment is mandatory to avail the Mediclaim facility.

Process for Emergency Medical Treatment

In Network Hospitals (Medi Assist Network):

In case of any emergency or elective procedure, do ensure you have clarity on the following points from Medi Assist before going ahead for admission & treatment:

- Is the procedure covered under the Group Mediclaim Policy?

- Are there any co-payment terms applicable on the procedure?

- The Employee / Family members can directly approach the hospitals along with the identity cards issued by Medi Assist (Mediclaim ID cards /Employee ID Cards / Authorization letter from Unit HR in the interim period). If the treatment is for dependents, in addition to the above, a Xerox copy of photo ID proof of patient is mandatory at the time of admission. The photo ID proofs which can be used are Aadhar card, Ration card, Voter ID, PAN card, Passport, etc.

- The hospital authorities will inform Medi Assist about the admission and the line of treatment basis which Medi Assist will authorize the cashless facility appropriately.

- The employee shall verify the charged bill by the hospital and sign the claim form only after the amount is verified.

In Non-Network Hospitals:

- The Employee / Family members can directly approach the hospitals for treatment.

- Employee shall give intimation to Mediclaim Helpdesk (Medi Assist) at EST and Unit HR department within 48 hours of admission into the hospital .

Mediclaim Helpdesk Contact details:

Helpline: 07947171717 Ext-: 3/040-68172656

Email ID: [email protected]

If the intimacy is not given in the stipulated time the claim cannot be processed.

- The employee shall settle the hospital bills on his/her own and obtain all relevant documents as mentioned below within 7 days of discharge from hospital. The employee shall submit the below documents to Mediclaim Help Desk.

- Claim forms (as per prescribed format) duly filled in all respects and signed

- Hospital final Bill with break-up and cash paid receipts in Original

- Diagnostic Reports with Dr Prescriptions and bills in Original

- Prescriptions and medicine bills in Original

- Discharge summary

- Any other documents like copy of case sheet, etc on case to case basis if required

- Prescriptions, bills and reports for the pre and post hospitalization treatment

Note: Any other document requested by the Medi Assist for processing the claim should be provided by the employee within the stipulated time.

- Employees are supposed to co-operate by submitting the necessary documentary evidence as required by Medi Assist TPA. Please refer annexure 1 for contact details.

In case, the documents pertaining to the claims submitted are not sufficient, Medi Assist will send intimation to respective employee to submit the same. If the documents are not received, such claims will not be processed beyond the third reminder by Medi Assist TPA or M/s. National Insurance Company Ltd. Employees are requested to submit the claim related documents within 30 days from the date of discharge. The Insurance Company shall settle the claim, if payable, through NEFT transfer to employees Bank Account.

Planned Medical Treatment

In Network Hospitals:

- The Employee / Family members will directly approach the hospitals 48 hours (two days) in advance along with the identity cards issued by Medi Assist/Mediclaim ID cards (Employee ID Cards / Authorization letter from concerned Unit HR team in the interim period). Simultaneously the employee will also intimate Medi Assist.

- The hospital shall fill up Pre-Authorization Format and send to Medi Assist by Fax/email

- Medi Assist will authorize the treatment and inform the hospital within 2 hours of receiving the intimation.

- The employee / family members will avail the treatment as per the planned date.

- At the time of discharge, employee shall fill up and sign the claim forms. The employee shall verify the bill charged by the hospital and sign the claim form only after the amount is verified.

Reimbursement of Pre & Post Hospitalization Expenses:

Group Mediclaim Policy covers the expenses incurred during 30 days prior to hospitalization and 60 days after hospitalization for Major surgeries.

Employee can seek reimbursement of such expenses by submitting the claim through a filled claim form and attaching all relevant documents, bills and receipts. The employee can send the claim to Mediclaim Help Desk who will arrange for the reimbursement of approved claim amount to the employee.

Employees can contact Mediclaim Helpdesk / Medi Assist at the email IDs and phone numbers mentioned under "Annexure 1" for necessary assistance, guidance and clarifications during admissions into the hospitals / claims etc

All Non-Payables are to be settled directly by the employees as they are not covered under the Policy.

Note : All claims are subject to the conditions applicable as per Policy with National Insurance Company Limited.

Salient Features of Group Mediclaim Policy covering

Covering Employees & Workmen of Dr. Reddy’s and their family members for 2023-24

1.Coverage: Members covered are Six (Including self)

- Employee

- Spouse/Same-sex partner

- Dependent Parents / In Laws up to the age of 95 years: Max 2 in any combination. [in case the member is continued in last policy there is no age limit]

- Dependent Children: Only 2 (3rd and 4th child coverage is extended only in case of twins or triplets)

- Children who are either above an age of 30 years or are not dependent are not eligible for coverage

- Married children are not eligible

- There is no age limit for differently abled children

2. Overall Family Limit

| Category | Coverage for | Limit | Remarks |

| 1 | Workmen in CTO- 1, 2 & 5 & 6 and FTO – 1, 2 & 3 | INR 4,00,000/- | Maximum permissible claim for Parents is INR 3,00,000 (INR Three lacs only ) for one Parent or both put together. There will be no co-payment for all claims of the Parents |

| 2 | All Staff (not covered under ESI) and Field Staff | INR 4,00,000/- | Maximum permissible claim for Parents is INR 3,00,000 (INR Three lacs only) for one Parent or both put together. There will be 10% co-payment for all claims of the Parents |

3. Contribution: The subsidized premium contribution to the medical insurance scheme during the period 1st September 2023 to 31st Aug 2024 is as below:

|

Member |

Contribution |

|

Self |

Nil |

|

Spouse |

INR 3000/- |

|

Per Child |

INR 3000/- each |

|

Per Parent/ In-law |

INR 7500/- each |

Note:

- The contribution mentioned above will be same across bands including trainees.

- Premium will be deducted via payroll in maximum 5 instalments for the Base Policy.

- The mid –year additions for new born baby / spouse addition for newly married employees must be updated within 30 days from date of birth/ date of marriage

4. Feature Highlights:

- Maternity cover of ₹ 75,000.

- Rehabilitation treatments will be covered for neurodevelopmental disorders & PwD (physiotherapy, speech therapy, behavioural therapies, alternative therapies) up to ₹ 20,000 for the family.

- Infertility treatments are covered separately up to ₹ 1,00,000

- PCOS/PCOD treatments covered for up to ₹ 25,000 in OPD/IPD. This would be considered as a part of the Infertility cover of ₹ 1 Lakh

- Cataract surgeries covered up to ₹ 40,000.

- Room Rent limits available up to ₹6000 and ₹ 12,000 for Normal & ICU respectively.

5. Additional Coverage (Top-Up):

- Employees can opt for additional coverage of 1 to 15 Lakhs beyond the overall family limit outlined in Sec. 2 above. If an employee opts for Top-up of 10 Lakhs or above, below additional coverage will be provided.

- Waiver on Co-pay condition under base and top-up Sum Insured

- Room Rent Limits are enhanced to ₹10,000